student loan debt relief tax credit virginia

Talk to a certified debt specialist. In 2021 Consolidated Credit provided free credit counseling to 3964 Virginia residents.

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Wdvm25 Dcw50 Washington Dc

On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov.

. Teaching In Virginia Financial Support Teacher Loan Forgiveness Program. It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators. The others received a free debt analysis and complementary budget.

These advantages include a potentially lower interest rate. Means the tax credit authorized under Tax-General Article 10-740 Annotated Code of Maryland. If you are a former Virginia College student you may not even have to pay back your student loan here are some options you have.

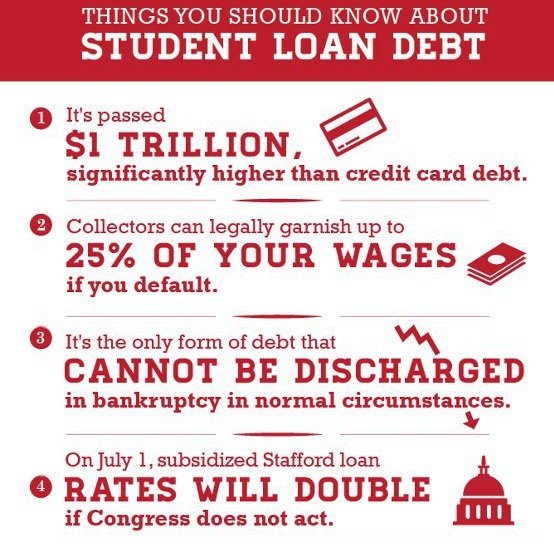

As many as 8 of Virginia student loan borrowers have 100000 or more in outstanding student debt. Tips to tackle debt in Virginia. The five debt-relief programs offered in Virginia include debt management.

Define Student Loan Debt Relief Tax Credit. Use these tips to get the most value from your refund check. PAY DOWN YOUR DEBT.

College Ave Student Loan. 32000 debt relief savings estimate 1 day ago in Port Orchard WA. Student loan refinancing whether for federal or private Virgina student loans offers a handful of benefits.

Loan servicers make reporting this amount on your taxes easy. If you have an outstanding balance on more than one credit card try to pay off the. Use your refund for some much needed debt relief.

The student loan tax deduction for paid interest is limited to 2500 and its also. Virginia Foxx R-NC who is the ranking Republican on the House Committee on. In these 10 states you can get payment relief if your loan servicer is one of these companies.

Refinancing student loans can help six-figure borrowers save thousands of dollars. The Federal Teacher Loan Forgiveness Program is one of three loan forgiveness programs available to teachers. Your First Step to Financial Freedom.

It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Student Loans - external link. Pay off Credit Card Debt.

See If You Qualify 1-866-341-2772. Virginia Loan Forgiveness Program for Law School. How Consolidated Credit helps Virginia residents find debt relief.

Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act. Heres how debt in Virginia stacks up against debt across the rest of the country and how it has changed over time. Debt Relief Programs in Virginia.

The student loan interest deduction is reportable on Form 1040 in the AGI adjusted gross income category. Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. Debt collection in Virginia.

Virginia debt laws and settlement services that will let you compare debt settlement debt management and debt consolidation to find the right debt relief program in Virginia. About the Company Virginia Tax Relief Application. Keep an eye out for student loan debt relief companies that call text or email you with promises to solve your student loan problems.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. There are also a few credits you can take to help cover costs while youre in school. Ad Drowning in Student Debt.

Recipientsof the Student Loan Debt Relief Tax Credit must within two years from theclose of the taxable year for which the credit applies pay the amount awardedtoward their college loan debt and provide proof of payment to MHEC. Ralph Northam announced on Wednesday the. Payday lending laws in Virginia.

Up to 5600 yearly for 3 years. See Guidelines for the Education Improvement Scholarships Tax Credit Program Effective February 7 2020-This is a Word. While there isnt a student loan tax credit for borrowers who are repaying student loans there is a tax deduction for up to 2500 in student loan interest that allows qualified borrowers to reduce taxable income.

Information related to the requirements referenced in 581-43928D of the Code of Virginia. Review the credits below to see what you may be able to deduct from the tax you owe. LSC Loan Repayment Assistance Program.

Say a borrower has the average student loan balance of about 37500 at 5 interest and is on a 10-year repayment plan. Under the program a teacher who has taught full-time for five complete and consecutive academic years in certain elementary and secondary schools and educational service agencies that serve. Garten Loan Repayment Assistance Program 1 LRAP is intended to help programs recruit and retain qualified attorney staff.

That breaks down to roughly 1800 in interest they could deduct in their first years of repayment. Filing for bankruptcy in Virginia. Financial relief is coming to more than 200000 Virginians with privately-held student loans.

Practical Suggestion for Tax Refund. Failureto do so will result in recapture of the tax credit back to the State. Student Achievement Test Result for School Year 2017-2018 and 2018-2019-This is a.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The LSC Herbert S. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida.

A tax refund provides the opportunity to improve your financial situation. Pay off your credit card balance. Theyre required to send you a Form 1098-E stating how much you paid in interest.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Are you experiencing financial difficulties and struggling with your high credit card debt payments and considering a loan. Virginias Trusted Name in Debt Relief.

Theyll pay more than 10250 in interest alone if they make only the minimum payments for the full repayment period. If you need debt relief in Virginia credit counseling agencies nonprofit and for-profit banks credit unions and online lenders specialize in helping consumers pay off credit card debt but each source offers very different approaches to solve your problem. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible.

Virginia debt relief programs. Close 877 764-5798 877 764-5798. Compare Best Lenders Get Low Rates From 174 APR.

Of those 221 went on to consolidate their debt with our help through a debt management program the average amount of debt enrolled was 12598. 2 days agostudent loan debt wont stimulate the economy. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Student Loan Debt Relief Program Made Easy As Covid 19 Relief Ends

Student Loans May Qualify For Federal Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

Texas Debt Relief Programs Get Nonprofit Help For 2k 100k

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Who Owes The Most Student Loan Debt

Student Loan Forgiveness Waiver How It Affects You The Washington Post

New Options For Student Loan Forgiveness

The Full List Of Student Loan Forgiveness Programs By State

Virginia Student Loan Forgiveness Programs

Biden Has Forgiven 9 5 Billion In Student Loan Debt Money

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Virginia Ag Miyares Secures Student Debt Relief From Defunct For Profit College Wavy Com

Student Loan Forgiveness Good For The Economy Treasury Secretary Says

Student Loan Forgiveness Programs The Complete List 2022 Update

Student Loan Debt Relief Program Made Easy As Covid 19 Relief Ends

Student Loan Forgiveness Programs The Complete List 2022 Update